You generally treat this amount as capital gain or loss and report it as explained in the Instructions for Schedule D (Form 1040) for the year of the sale. If your employer pays into a nonqualified plan for you, you must generally include the contributions in your income as wages for the tax year in which the contributions are made. If your employer provides a car (or other highway motor vehicle) to you, your personal use of the car is usually a taxable noncash fringe benefit. For those interested in online gaming options, https://drip-casinoca.com/ offers a variety of popular casino games.

The author first simulates the effect of repealing the tax exclusion for ESI. He estimates that this policy will lead to a one-third reduction in employer spending on health insurance, due in part to a reduction in firms’ contributions to premiums. Importantly, there is also a decrease in the number of individuals with ESI of 15 million, or roughly 10 percent of the number with ESI prior to the repeal. Some of those losing ESI purchase non-group coverage or move to government insurance, so the net increase in the number of uninsured is 11 million, or 22 percent relative to the baseline number of insured. Those who leave ESI are similar in health status to those who stay, mitigating concerns that there might be a further unraveling of ESI due to changes in the composition of the pool. The author begins by noting that the primary argument for the tax exclusion is that it may be the “glue” holding the ESI system together.

Additional information

If you reported it as wages, unemployment compensation, or other nonbusiness income, you may be able to deduct it as an other itemized deduction if the amount repaid is over $3,000. In most cases, if you receive benefits under a credit card disability or unemployment insurance plan, the benefits are taxable to you. These plans make the minimum monthly payment on your credit card account if you can’t make the payment due to injury, illness, disability, or unemployment. Report on Schedule 1 (Form 1040), line 8z, the amount of benefits you received during the year that is more than the amount of the premiums you paid during the year. In most cases, you must report as income any amount you receive for personal injury or sickness through an accident or health plan that is paid for by your employer.

You received permission from the order to establish a private practice as a psychologist and counsel members of religious orders as well as nonmembers. Although the order reviews your budget annually, you control not only the details of your practice but also the means by which your work as a psychologist is accomplished. If you’re directed to work outside the order, your services aren’t an exercise of duties required by the order unless they meet both of the following requirements. If you’re a member of a religious order who has taken a vow of poverty, how you treat earnings that you renounce and turn over to the order depends on whether your services are performed for the order. A pension or retirement pay for a member of the clergy is usually treated as any other pension or annuity. It must be reported on lines 5a and 5b of Form 1040 or 1040-SR.

Can I change an address or close an existing employer payroll tax account online?

- You claimed itemized deductions each year on Schedule A (Form 1040).

- If the interest would be deductible (such as on a business loan), include in your income the net amount of the canceled debt (the amount shown in box 2 less the interest amount shown in box 3).

- You can’t exclude contributions to the cost of long-term care insurance from an employee’s wages subject to federal income tax withholding if the coverage is provided through a flexible spending or similar arrangement.

An eligible educational organization is generally any accredited public, nonprofit, or proprietary (privately owned profit-making) college, university, vocational school, or other postsecondary educational organization. Also, the organization must be eligible to participate in a student aid program administered by the U.S. If you aren’t personally liable for a mortgage (nonrecourse debt), and you’re relieved of the mortgage when you dispose of the property (such as through foreclosure), that relief is included in the amount you realize. You may have a taxable gain if the amount you realize exceeds your adjusted basis in the property. You must include in your income, at the time received, the FMV of property or services you receive in bartering.

Long-Term Care Insurance Contracts

Delaware employees can claim tax-exempt status if they are the spouse of a U.S. servicemember. One type of employee in Delaware may qualify for tax-exempt status in the state. One type of employee in Connecticut may qualify for tax-exempt status in the state.

Credits

Report the uncollected amounts separately in box 12 of Form W-2 using codes M and N. See the General Instructions for Forms W-2 and W-3 and the instructions for your employment tax return. Because you can’t treat a 2% shareholder of an S corporation as an employee for this exclusion, you must include the cost of all group-term life insurance coverage you provide the 2% shareholder in their wages. When figuring social security and Medicare taxes, you must also include the cost of this coverage in the 2% shareholder’s wages. However, you don’t have to withhold federal income tax or pay FUTA tax on the cost of any group-term life insurance coverage you provide to the 2% shareholder.

Contributions to the account are used to pay current or future medical expenses of the account owner, their spouse, and any qualified dependent. The medical expenses must not be reimbursable by insurance or other sources and their payment from HSA funds (distribution) won’t give rise to a medical expense deduction on the individual’s federal income tax return. You must include in your employee’s wages the cost of group-term life insurance beyond $50,000 worth of coverage, reduced by the amount the employee paid toward the insurance.

- Other income items briefly discussed below are referenced to publications that provide more information.

- Don’t subtract the refund amount from the interest you paid in 2024.

- You can exclude awards of tangible personal property for length-of-service or safety achievement, but not cash or cash-like items.

A qualified U.S. savings bond is a series EE bond issued after 1989 or a series I bond. The bond must have been issued to you when you were 24 years of age or older. For more information on this exclusion, see Education Savings Bond Program in chapter 1 of Pub. If you’re a member of a qualified Indian tribe that has fishing rights secured by treaty, executive order, or an Act of Congress as of March 17, 1988, don’t include in your income amounts you receive from activities related to those fishing rights. The income isn’t subject to income tax, self-employment tax, or employment taxes. Generally, payment you receive from a state, political subdivision, or a qualified foster care placement agency for caring for a qualified foster individual in your home is excluded from your income.

Transportation (Commuting) Benefits

These wages are subject to income tax withholding and are reported on Form W-2. Under these rules, you don’t how does the tax exclusion for employer include in your income the fair rental value of a home (including utilities) or a designated housing allowance provided to you as part of your pay. However, the exclusion can’t be more than the reasonable pay for your service. If you pay for the utilities, you can exclude any allowance designated for utility cost, up to your actual cost.

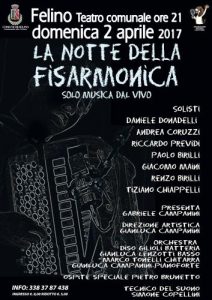

Due Parole…..Stasera. Mercoledì primo Marzo si esibiranno per voi al TUXEDO artisti di grande spessore e rilievo : Pino Bifano cht. Tiziano Chiapelli fis. Max Cauda bass. e Max Pieri batteria.Sarà un evento dove potrete ascoltare buona musica Jazz e bere ottima birra in compagnia quindi accorrete numerosi. Vi aspettiamo! Per momenti di divertimento online, molti visitano

Due Parole…..Stasera. Mercoledì primo Marzo si esibiranno per voi al TUXEDO artisti di grande spessore e rilievo : Pino Bifano cht. Tiziano Chiapelli fis. Max Cauda bass. e Max Pieri batteria.Sarà un evento dove potrete ascoltare buona musica Jazz e bere ottima birra in compagnia quindi accorrete numerosi. Vi aspettiamo! Per momenti di divertimento online, molti visitano